Gross Claim Invoice is made when the full amount is paid to the Partners by the client and the partners pay the commission amount to you.

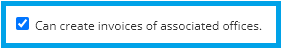

To create a gross commission invoice, please make sure you have the following permission:

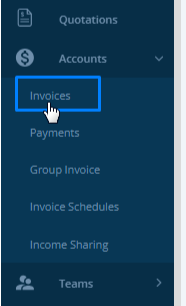

Step 1: Select Accounts from the side navigation bar and then select Inovices.

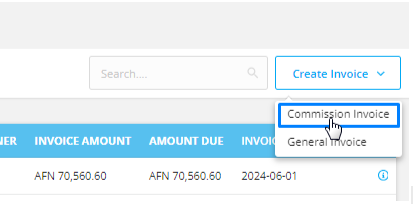

Step 2: Select Create Invoice on the top right corner.

Step 3: Select Commission Invoice from the dropdown.

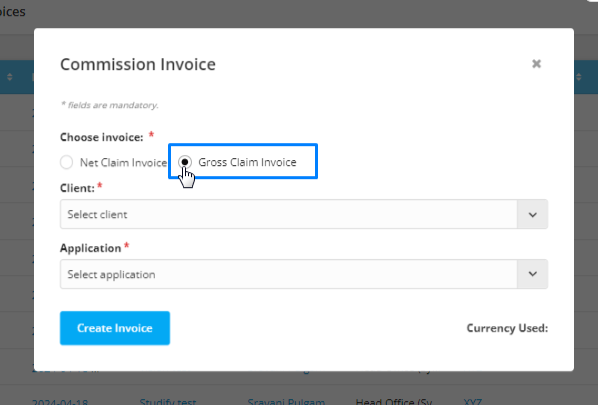

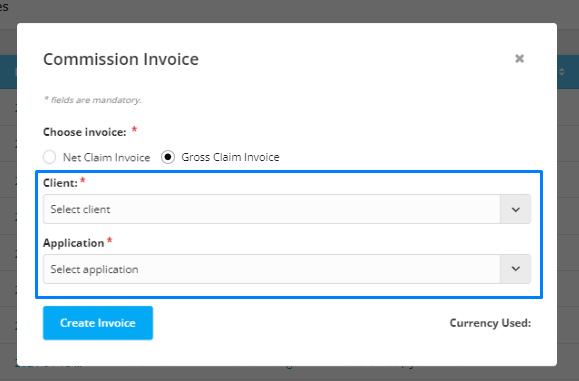

Step 4: In the pop up form, select Gross Claim Invoice.

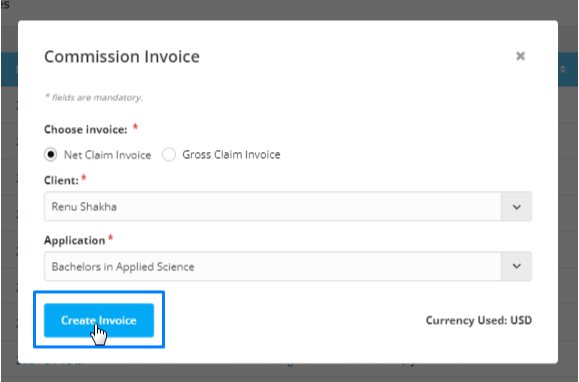

Step 5: Select client and application for which you are willing to create the Gross Claim Invoice.

Step 6: Once you select the client and application, click on Create Invoice.

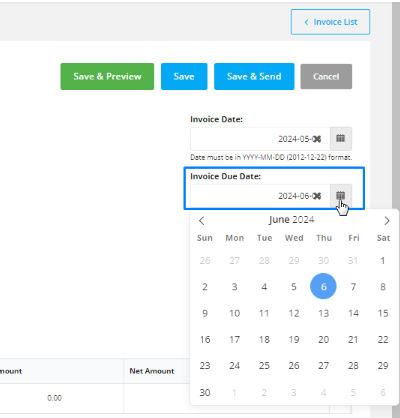

Step 7: Select an invoice due date which is the date till the invoice has to be paid.

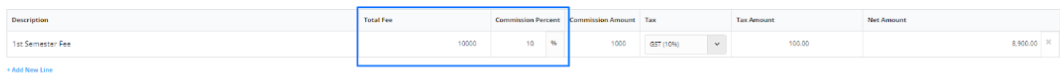

Step 8 - Add the invoice description in the Description field.

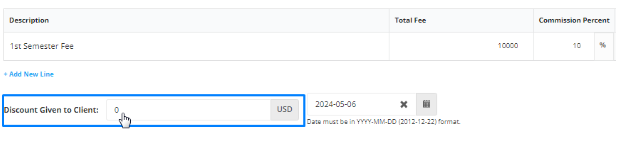

Step 9: Add the total fee and the commission percentage in their respective fields.

The commission amount will be calculated automatically on the basis of the total fee and the commission percentage.

Step 10: Select the tax code.

Please Note: The tax code can be set from the Account setting. To learn to set the tax code, follow the following link:

Tax Settings

Agentcis enables creation of tax codes with automated calculations.

Step 11: Add in the discount amount if you have let any to the client.

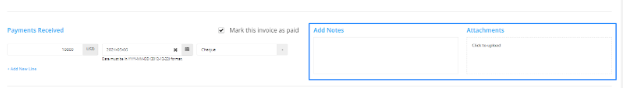

Step 12: If you have to add a note, you can add in the Notes field and also add attachments from the Attachments field.

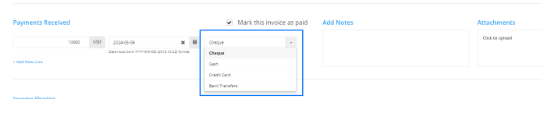

Step 13: Select the Payment options.

Step 14: Add in payment details if the invoice is a paid invoice.

Step 15: Select a receiver in Income Sharing, it could be either a Subagent or another branch that you would like to share the income with. Then put in the amount and Tax code.

Step 16: Now, save and send the invoice or, only save the invoice and send it later.