What is Payable Income Sharing?

When you add a subagent to an invoice in Agentcis, that automatically creates a payable income sharing invoice.

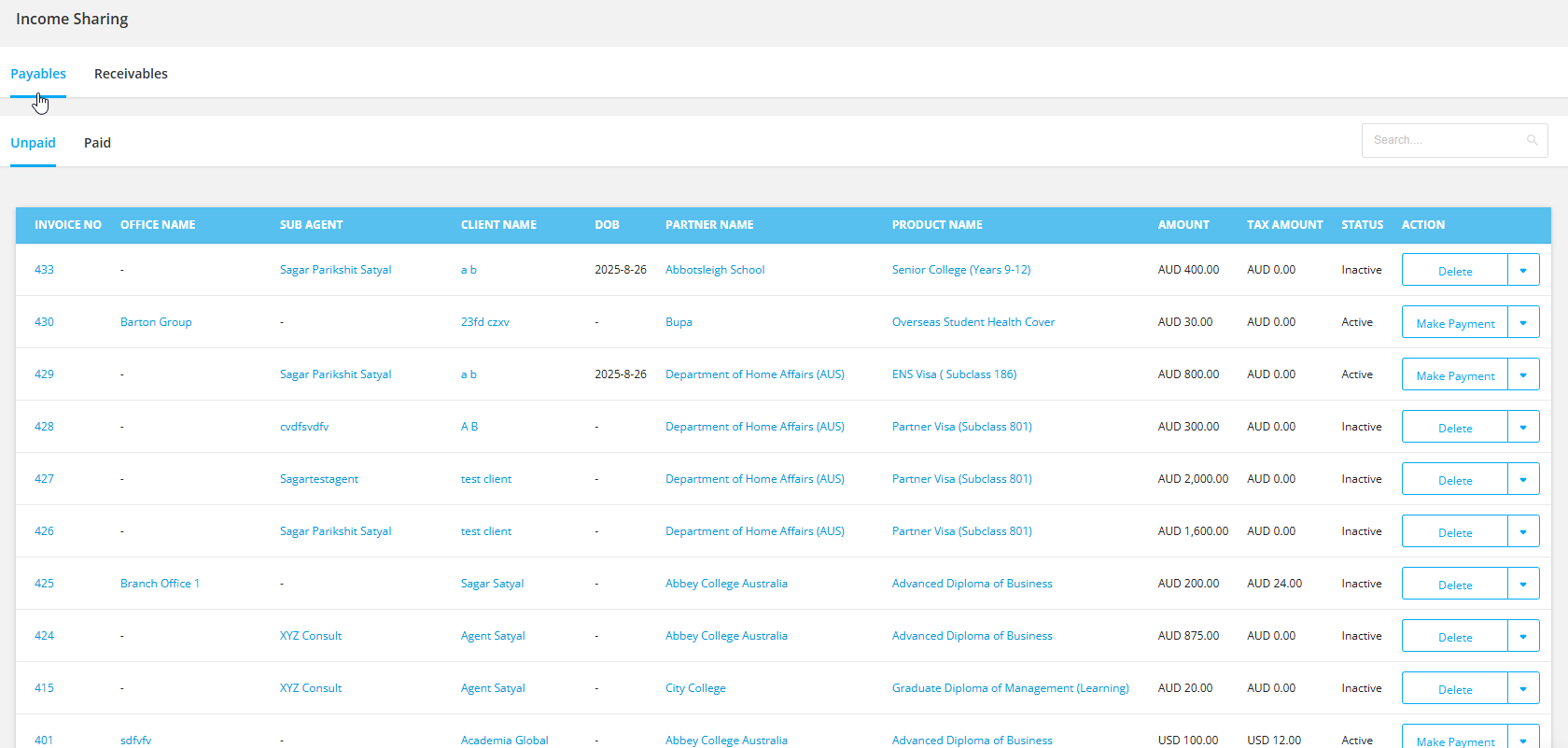

Payable income sharing refers to the portion of income that an agent owes to other branches or subagents (because some commission was agreed to be shared).

There are two states of payable income sharing:

Unpaid Payable Income Sharing: The agent has not yet received the full commission (or hasn't yet fulfilled the share with subagents or branches).

Paid Payable Income Sharing: The agent has already received the income and has subsequently paid the portions owed to subagents or branches.

For example,

Scenario | What Happens | Payable Share |

Your Agency with a Sub Agent | A university pays your agency a commission of $1,000 for enrolling a student. Since a Sub Agent helped bring that student, your agency agrees to give them 30%. | Your agency keeps $700 and owes the Sub Agent $300. Until paid, the system shows Unpaid Payable Income Sharing. |

Payment Completed | After your agency receives the commission, you pay the Sub Agent their $300 share. | The record updates to Paid Payable Income Sharing. |

Multiple Sub Agents | Your agency earns $1,000 commission. Two Sub Agents were involved: one gets 20% ($200) and another gets 10% ($100). | Your agency owes $300 total. It stays payable until both Sub Agents are paid. |