When creating invoices, tax is one of the most important elements. The tax you apply depends on your country of operation and local government rules.

To make this easier, Agentcis lets you create different tax codes (like VAT, GST, etc.) with their respective tax rates. Once set up, the system automatically calculates the tax on invoices — saving you time and reducing errors.

To add or edit different tax codes, please make sure you have the permission to do so.

Then,

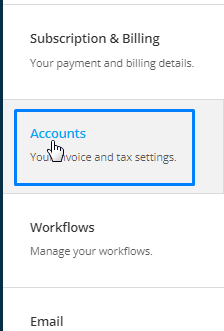

Step 1: Select settings from the top info bar and then select Account from the list.

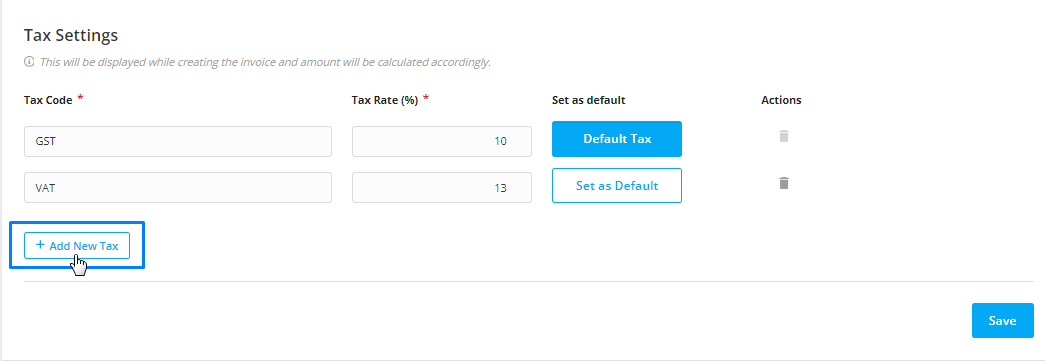

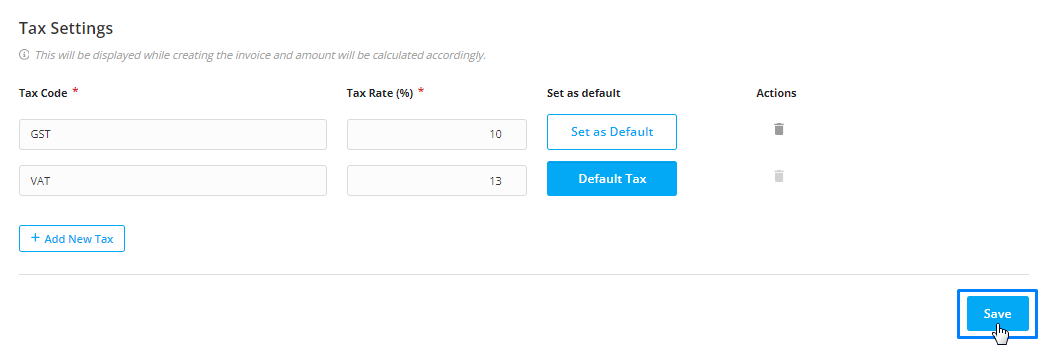

Step 2: From the Tax settings section select the tab Add New tax.

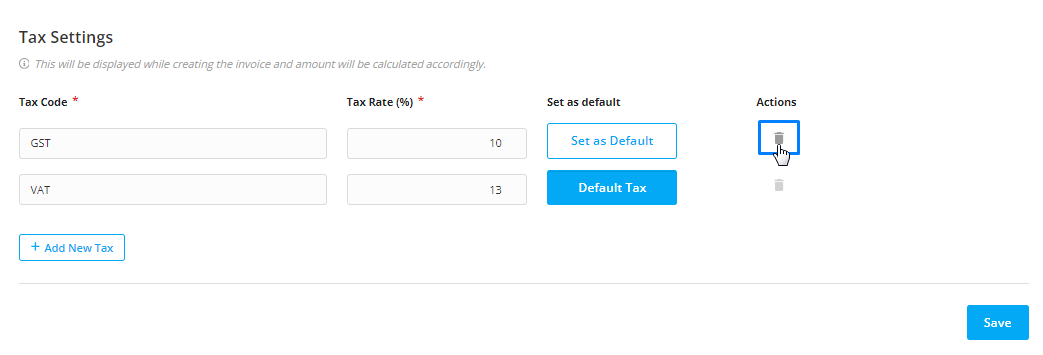

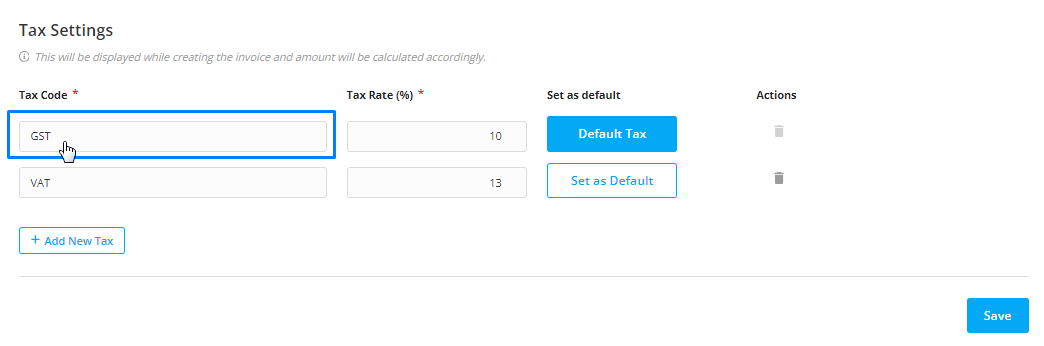

Step 3: Here you can add the tax codes such as GST, VAT and so on.

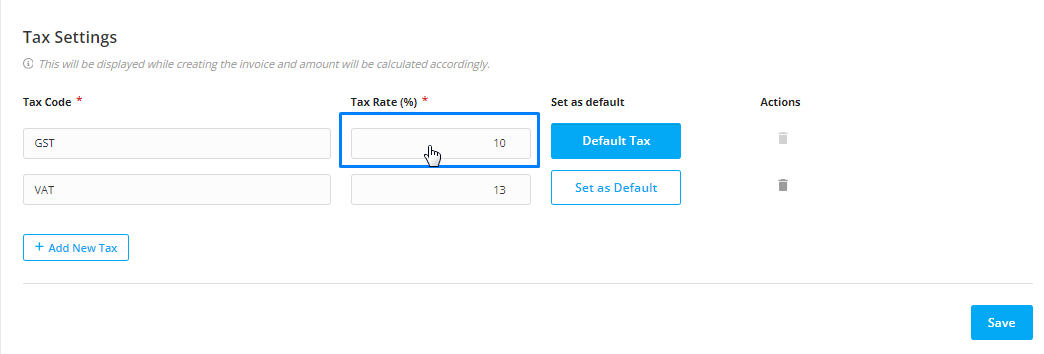

Step 4: You can then add the tax rate.

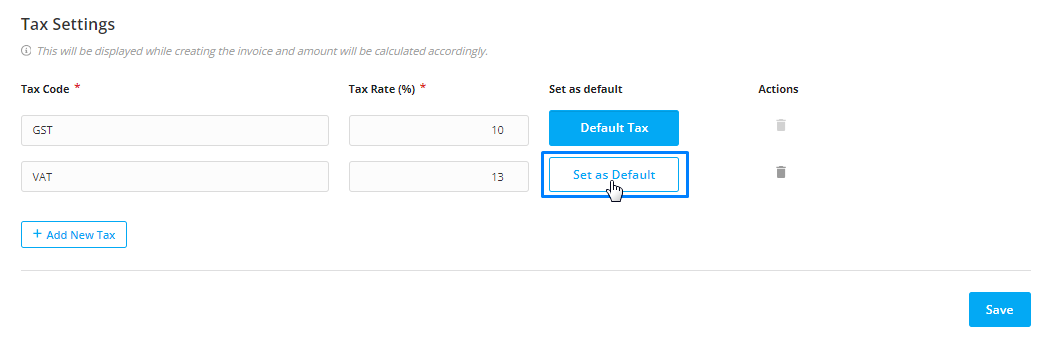

Step 5: You can set the tax code default if you want to do so by selecting the Set as Default tab.

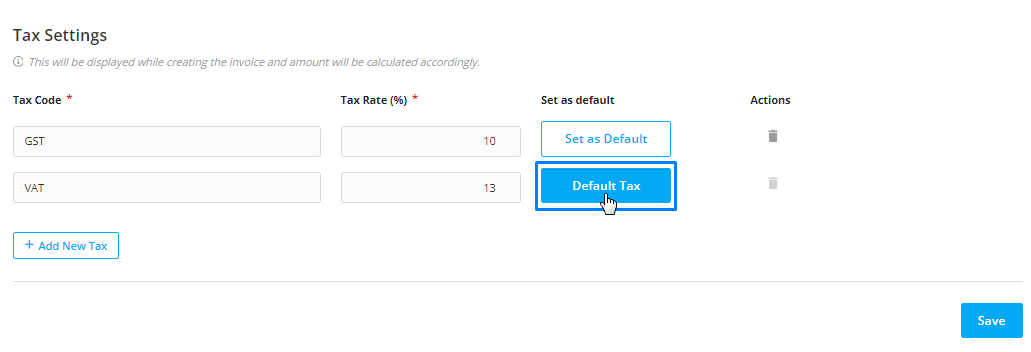

Once the tax code is set as default, it will be shown as Default tax.

Step 6: Select the Save tab once you complete.

Step 7: You can return to this page whenever you want to delete the Tax code/ add new or make any other changes.